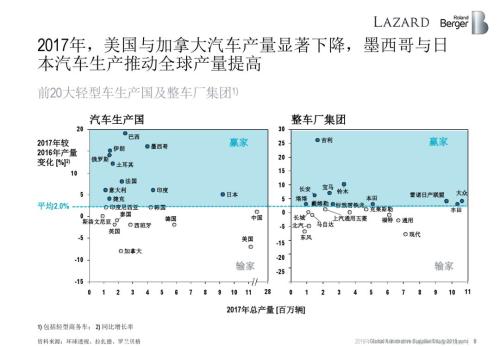

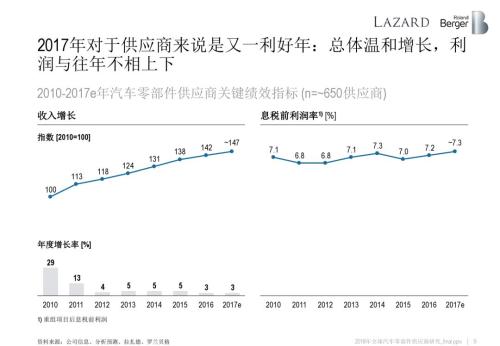

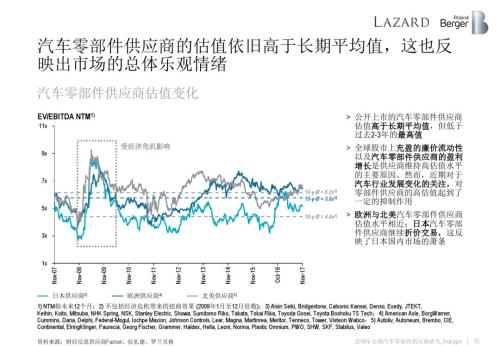

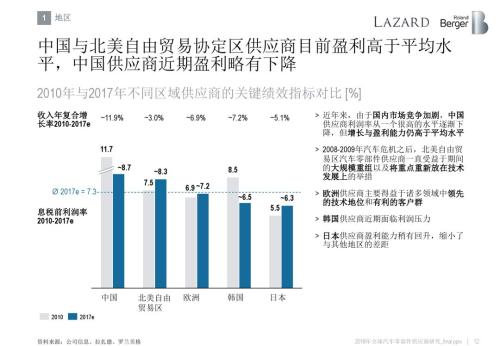

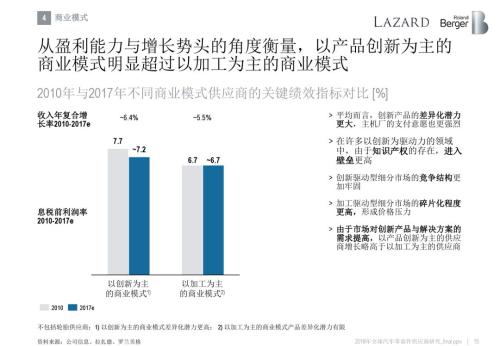

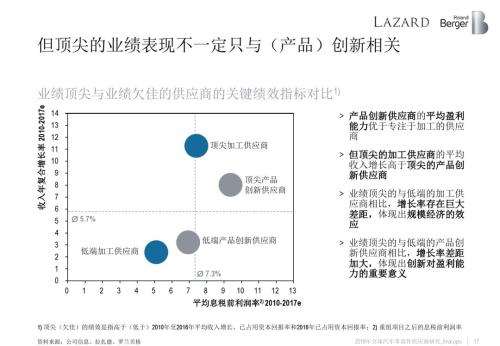

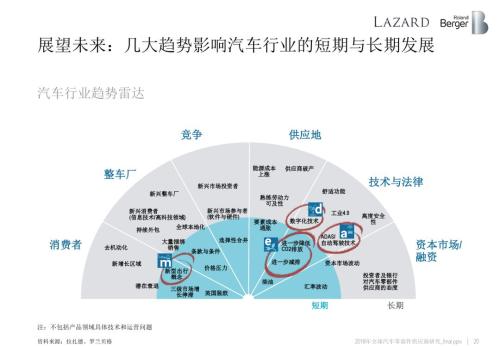

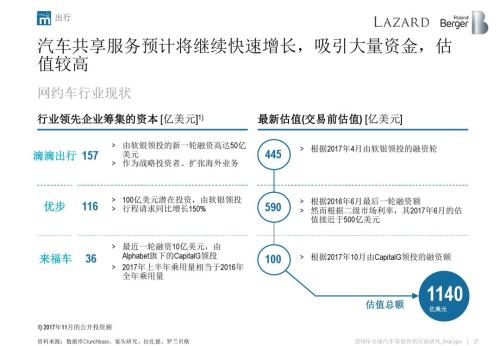

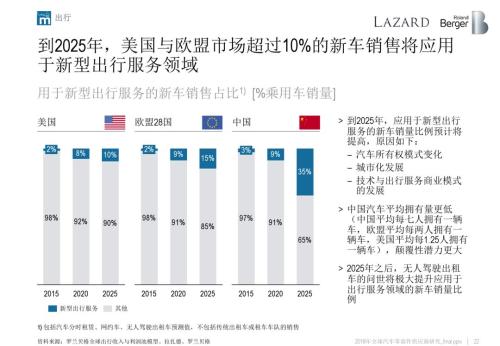

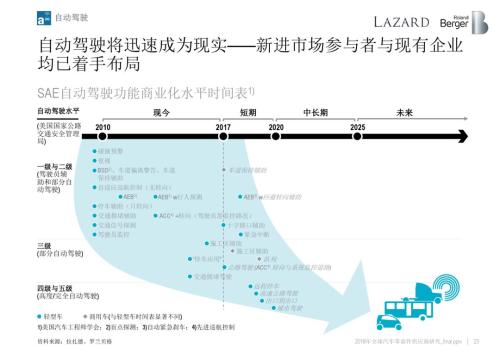

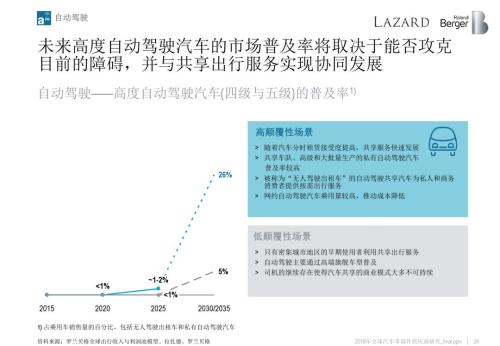

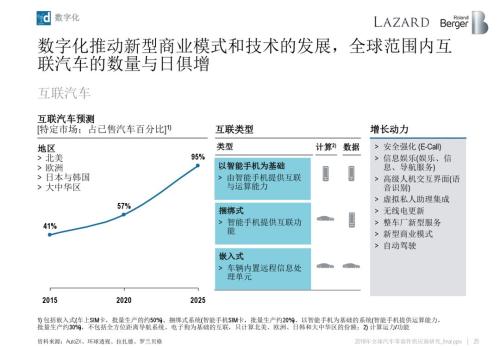

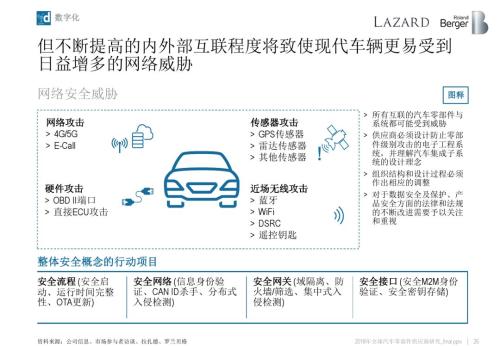

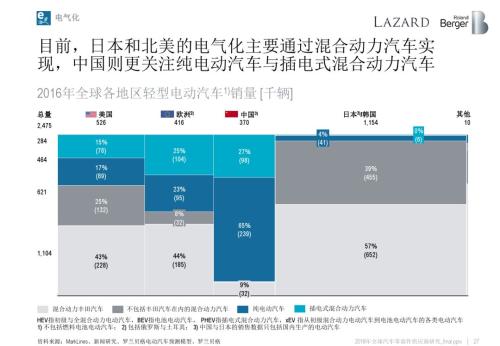

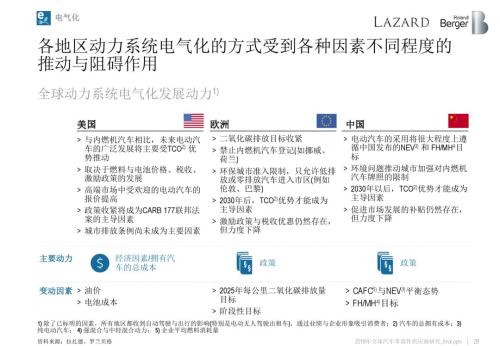

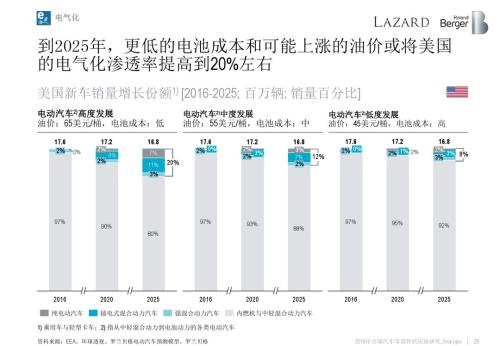

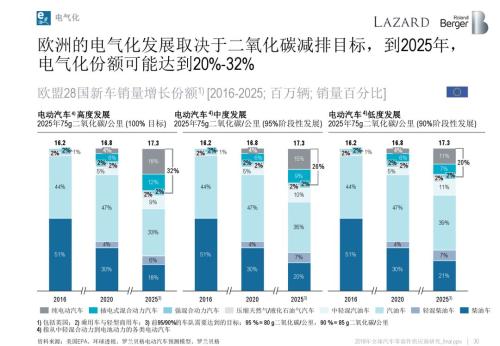

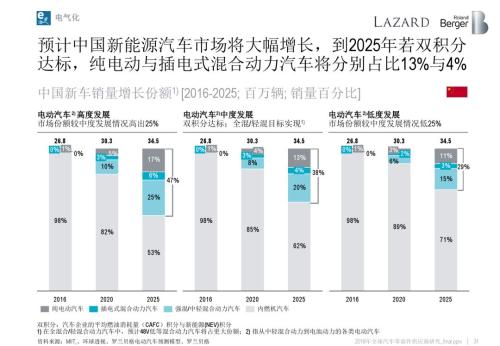

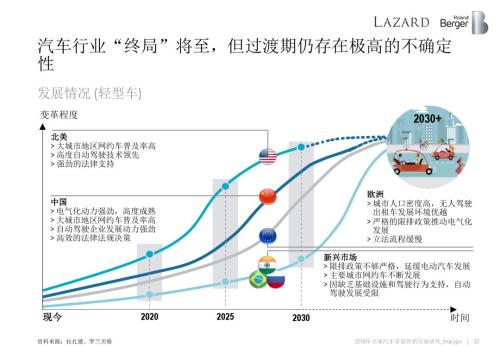

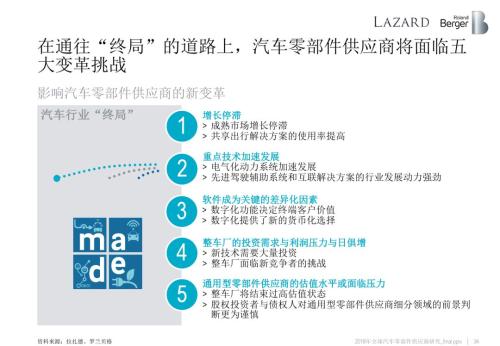

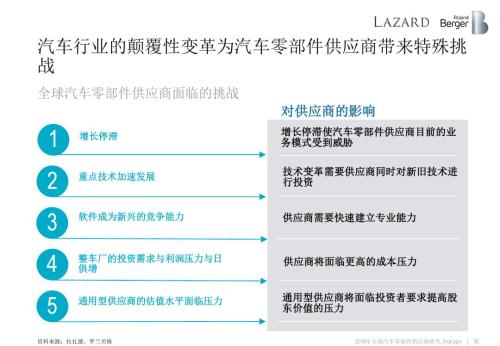

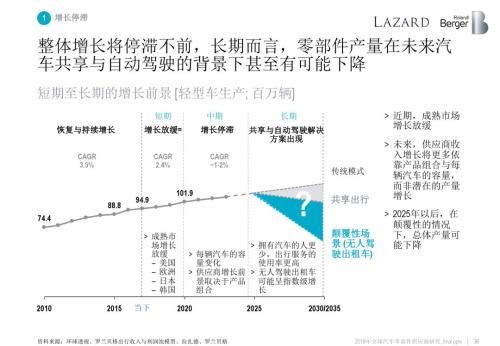

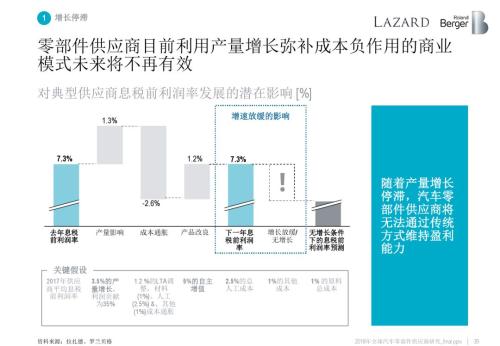

Recently, Roland Berger joined hands with financial services company Lazard to publish "Global Auto Parts Supplier Research 2018", which analyzes the development status and challenges of about 650 auto parts suppliers worldwide and lists challenges The key initiatives that need to be taken. The report predicts that in 2018, the global auto parts industry will continue to grow, but the growth rate will slow down. The combination of travel, auto-pilot, digitization and electrification will continue to change the auto industry and cause disruption in all auto parts. With change, it is imperative for suppliers to transform their business model to meet the “final†challenge. In 2017, the automotive industry continued to grow globally, but signs of weakness have begun to appear. The overall environment in 2018 will be positive. Global auto parts suppliers' revenue is expected to increase by 3% and continue to maintain profitability. The average EBIT margin is about 7.3%, which is the same as 2017. The valuation of parts suppliers is still higher than the long-term average, reflecting the overall optimism of the market. The profits of China and NAFTA regional suppliers are above average, but due to the intensified competition in the domestic market, the recent earnings of Chinese suppliers have slightly decreased and the growth continues to slow. Roland Berger believes that the four major trends in the automotive industry - travel services, autonomous driving, digitalization and electrification - are driving accelerated disruption. The new travel business model will disrupt car ownership, personal travel and logistics. By 2025, more than 10% of new car sales in the U.S. and EU markets will be applied to new travel services, and this proportion will be as high as 35% in China. Autopilot will also quickly become a reality. In the next 15-20 years, the market penetration rate of Class 4/5 class self-driving cars will reach 5%-26%, and it will achieve synergistic development with shared travel services. In the field of digitization, interconnection technology is becoming a mainstream application, and artificial intelligence will also provide unlimited possibilities for the development of the automotive industry. At the same time, under the influence of regulatory pressures and accelerated technological development, the electrification of the automaker has a strong momentum. It is expected that by 2025, the market share of electric vehicles will account for 8%-20% in the United States and 20%-32% in Europe. It is 29%-47% in China. Johan Karlberg, a partner at Roland Berger, said: “The disruptive change in the Chinese market is the most obvious. Unit growth is rapidly disappearing, sharing trips lead the world, and the electrification of power systems is also growing at a rapid rate of 50% per year. The trend will quickly reshape parts suppliers and their business models." Driven by these trends, the automotive industry will inevitably usher in a "final situation," but there is still a high degree of uncertainty in the transitional period. On the road leading to the "final situation", auto parts suppliers will face five major challenges for change: stagnation in growth, accelerated changes in key technologies, and mastery of software capabilities will become necessary conditions in the emerging competitive environment, hardware generalization, and general-purpose spare parts supply The valuation of the business is under pressure. At the same time, however, disruptive changes have also provided traditional parts suppliers with an opportunity to transform from hardware sales to sales of functions and services. In 2017, many suppliers achieved further growth through M&A investment. Therefore, the "final" strategy includes the exit and transition to new growth areas, and it is increasingly important to seize the opportunity to establish new partnerships. “Sharing trips, autopilot, digitization and electrification will continue to change the entire automotive industry,†said Ron Zheng, a partner at Roland Berger. “Parts suppliers will inevitably transform existing business models from a clear overall strategy. To reduce operating costs, from improving organizational structure and management models to building new innovative thinking." The professional equipment applied for automatic assembling of the automotive Starter, and integrated with functions of robot feeder, electrical performance tester as well as visual system. Possible for you to adjust parameters for data analysis and quality control. JINLAN provides you complete solutions for start production, including assembly solutions of drive shaft, ORC drive gear and electromagnetic switch as well as the tests related. Starter General Assembly Line,Starter Assembly Line,Vehicle Starter Assembling,Automatic Starter Assembling Line Wujiang Jinlan Machinery Manufacture Co.,Ltd , https://www.jinlan-technology.com